The Central Bank of India, one of the oldest and most prestigious public sector banks in India, is known for its unwavering commitment to economic development and customer service. With a history dating back to 1911, the bank has played a significant role in shaping India’s financial landscape. As we look toward the future, the Central Bank of India continues to expand its footprint and offer lucrative career opportunities for individuals aspiring to build a career in banking and finance.

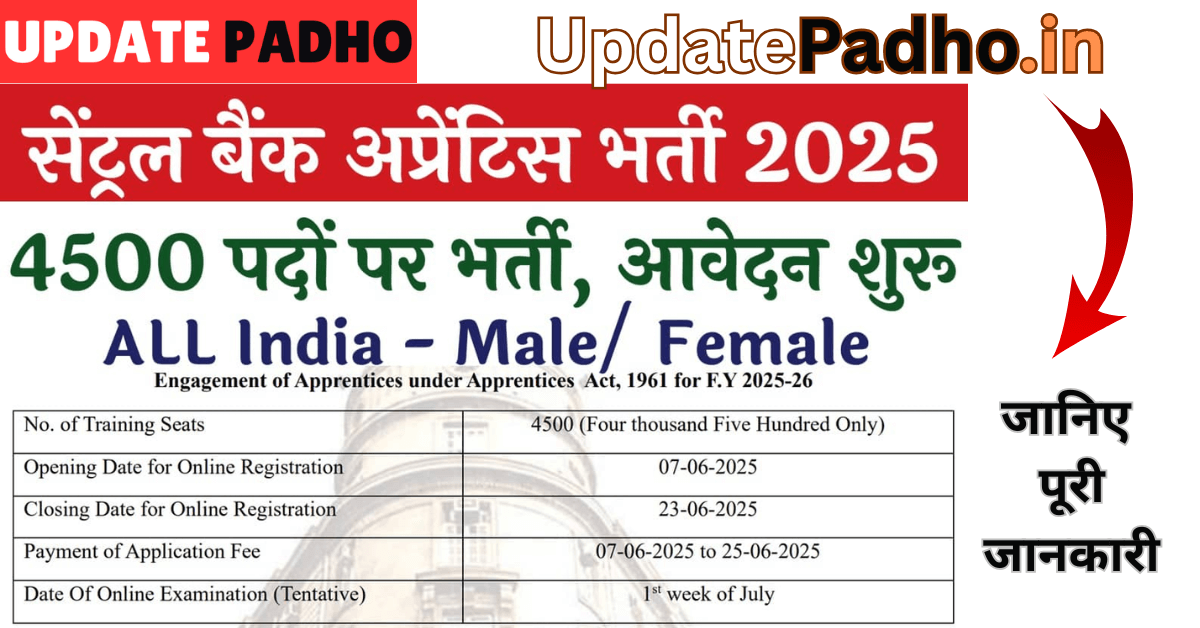

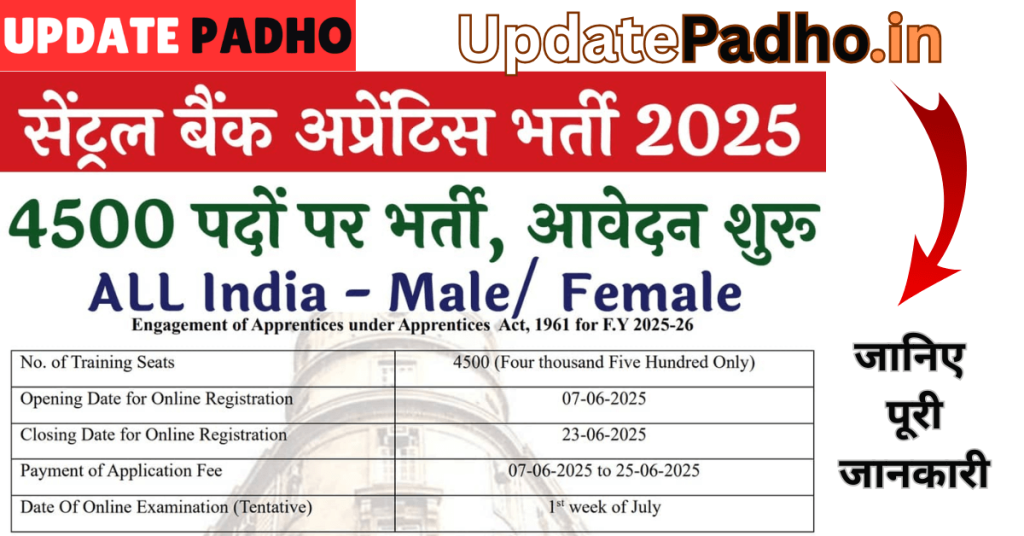

In 2025, the Central Bank of India is set to open a range of vacancies for various positions, attracting both fresh graduates and experienced professionals. This blog will give you a comprehensive understanding of the Central Bank of India vacancies for 2025, including job roles, eligibility criteria, application process, and tips for cracking the recruitment exams.

Central Bank of India Overview

Before delving into the specifics of the vacancies, it’s important to understand the significance of the Central Bank of India. Established as a public sector bank, it is one of the largest and most trusted banks in India, offering a variety of banking products and services. The bank has a nationwide presence with a vast network of branches, and it has also been at the forefront of introducing technological advancements in the banking sector.

As part of its ongoing expansion and development, the Central Bank of India is constantly on the lookout for dynamic, skilled, and dedicated individuals who can contribute to its growth and success.

Types of Vacancies in 2025

The Central Bank of India will announce vacancies for a variety of roles in 2025, catering to different levels of experience and educational qualifications. The primary job roles that are expected to be available include:

- Probationary Officer (PO)

- This is one of the most sought-after positions in the banking sector. A Probationary Officer is responsible for managing various banking operations, customer service, and financial products. It’s an entry-level role that offers great growth potential and career advancement opportunities.

- Clerk

- Clerks play an essential role in day-to-day banking operations, such as handling customer inquiries, managing accounts, and performing administrative tasks. This position is ideal for those who have a keen eye for detail and a passion for customer service.

- Specialist Officer (SO)

- The Specialist Officer role is a more advanced position, designed for individuals with specialized skills in areas like IT, risk management, HR, law, and marketing. SOs help manage niche functions within the bank and often require a higher level of expertise.

- Manager (Scale II/III)

- Managers oversee the functioning of specific departments or branches, ensuring smooth operations and the achievement of business goals. These positions typically require a few years of experience in the banking sector, along with leadership skills.

- Assistant Manager

- Assistant Managers support branch managers and contribute to the efficient functioning of a branch. They typically handle administrative duties, customer queries, and support the implementation of various banking services.

Eligibility Criteria

The eligibility criteria for different roles in the Central Bank of India vary based on the position and the level of expertise required. Below are the general eligibility guidelines:

- Age Limit: The age limit for various positions typically ranges from 20 to 30 years for entry-level positions (PO, Clerk) and can extend up to 40 years for specialist roles. Age relaxations are provided to candidates from reserved categories, as per government norms.

- Educational Qualification:

- For Probationary Officer (PO) and Clerk roles, candidates should have a graduation degree from a recognized university or institution.

- For Specialist Officer (SO) roles, candidates must have relevant professional qualifications or specialized degrees in the respective fields (e.g., IT, law, marketing).

- For Manager and Assistant Manager roles, candidates typically need a postgraduate degree in management or related fields, along with relevant experience in the banking or finance sector.

- Experience:

- For entry-level positions like PO and Clerk, prior banking experience is not mandatory.

- For specialist roles and managerial positions, candidates are expected to have a certain number of years of experience in relevant fields.

Application Process

The application process for Central Bank of India vacancies generally follows a structured online procedure. Here’s a breakdown of the typical steps involved:

- Online Registration: Candidates need to visit the official website of the Central Bank of India and create an account to register for the exam.

- Filling the Application Form: After registration, candidates need to fill out the application form, providing details like educational qualifications, personal information, and work experience (if applicable).

- Application Fee: Candidates are required to pay an application fee, which varies based on the category they belong to. Payment is typically done through online banking or debit/credit cards.

- Admit Card: Once the application is successfully submitted, candidates can download their admit cards from the official website. The admit card contains important details such as the exam date, venue, and time.

- Written Examination: The written exam is an essential part of the selection process. It typically consists of multiple-choice questions (MCQs) covering subjects such as reasoning, quantitative aptitude, English language, general awareness, and professional knowledge (for SO roles).

- Interview: Based on the written exam performance, candidates are shortlisted for a personal interview. The interview panel evaluates the candidate’s communication skills, personality, and suitability for the role.

- Final Selection: After the interview, a final merit list is prepared, and selected candidates are issued appointment letters.

Conclusion

A career at the Central Bank of India in 2025 offers immense potential for professional growth and personal development. With its stable reputation, wide-ranging opportunities, and attractive salary packages, the bank is a great place for individuals looking to make their mark in the banking sector.

Whether you’re aiming for an entry-level role like Probationary Officer or seeking a more specialized position, the Central Bank of India vacancies in 2025 present a promising opportunity to secure a long-term, rewarding career in the banking industry.